NFT Dashboard Application Development.

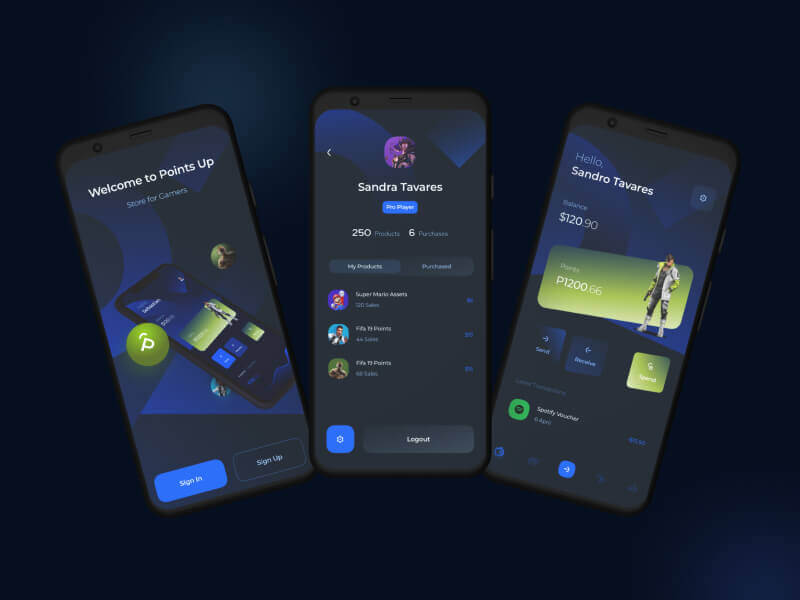

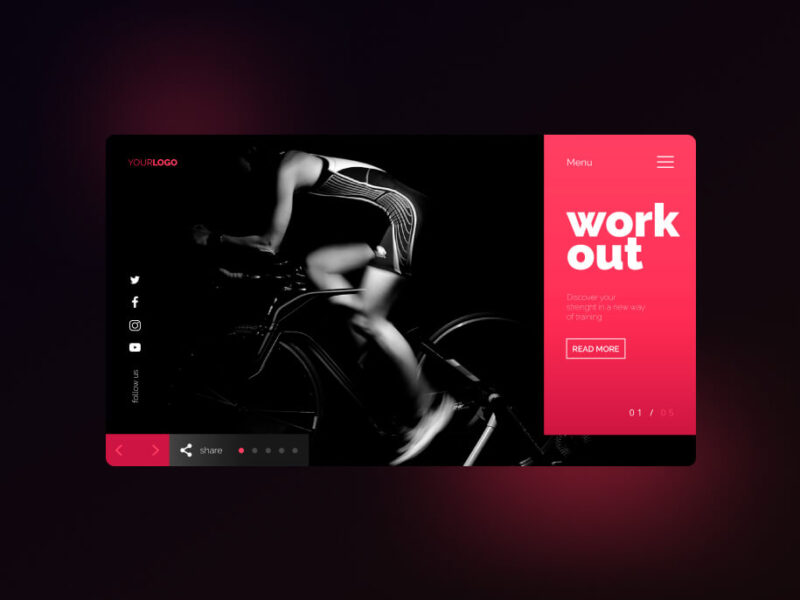

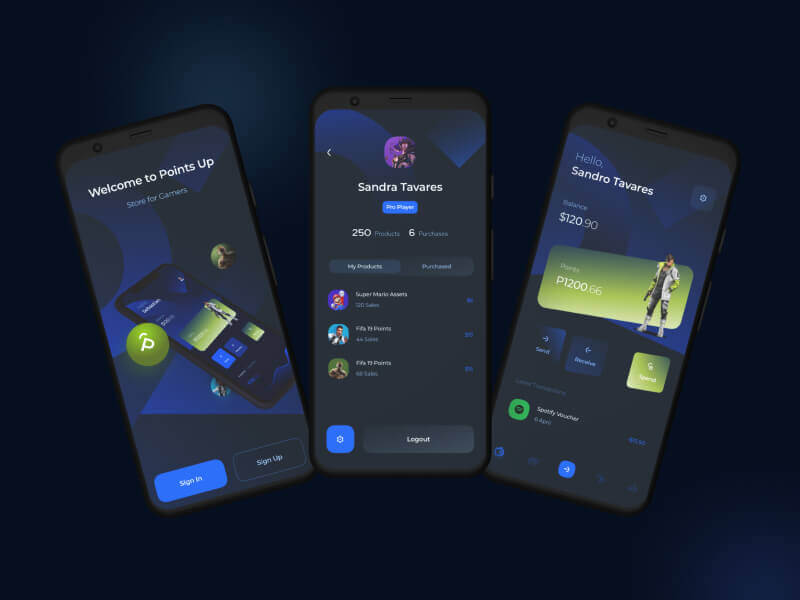

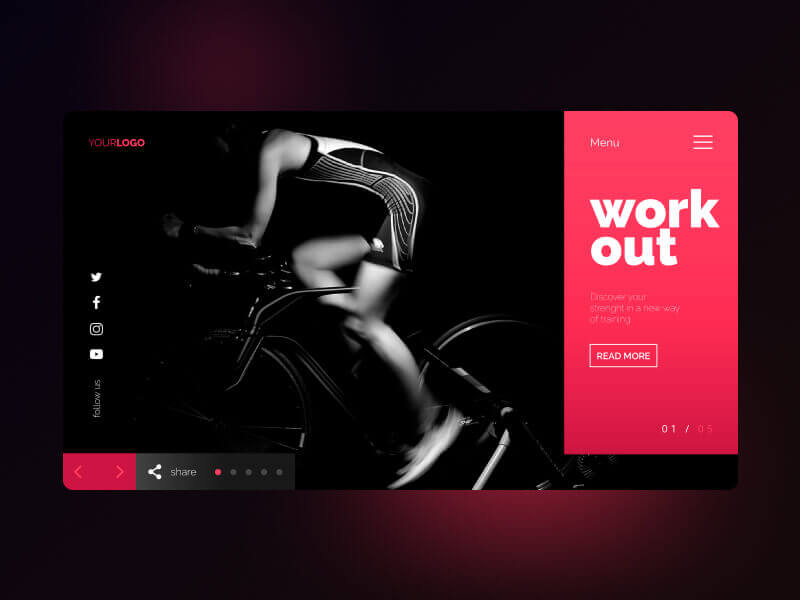

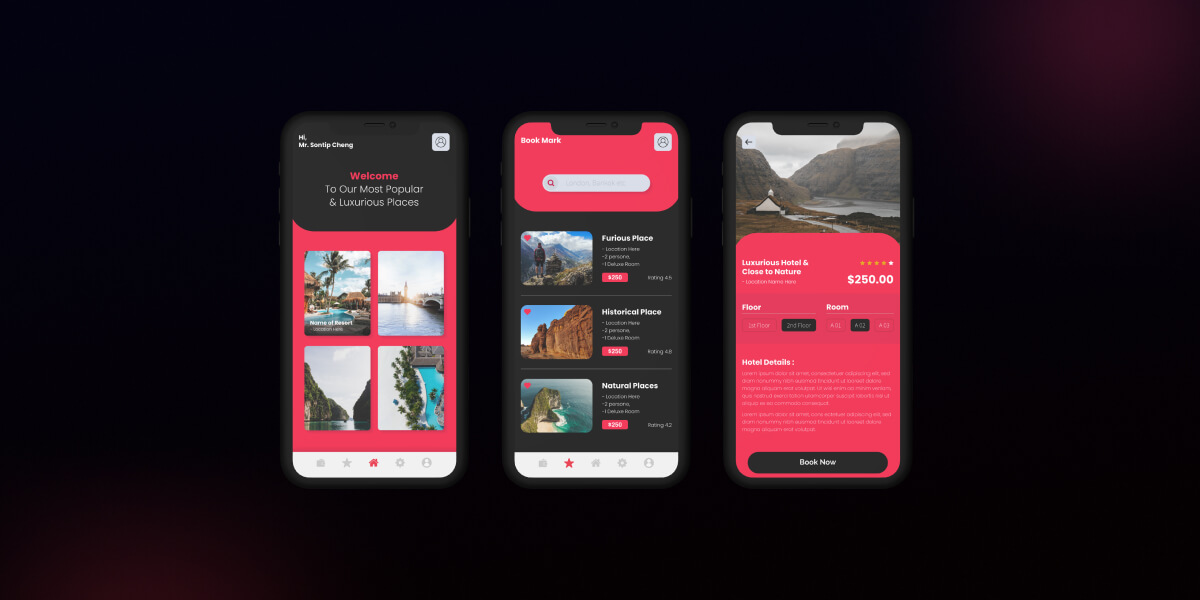

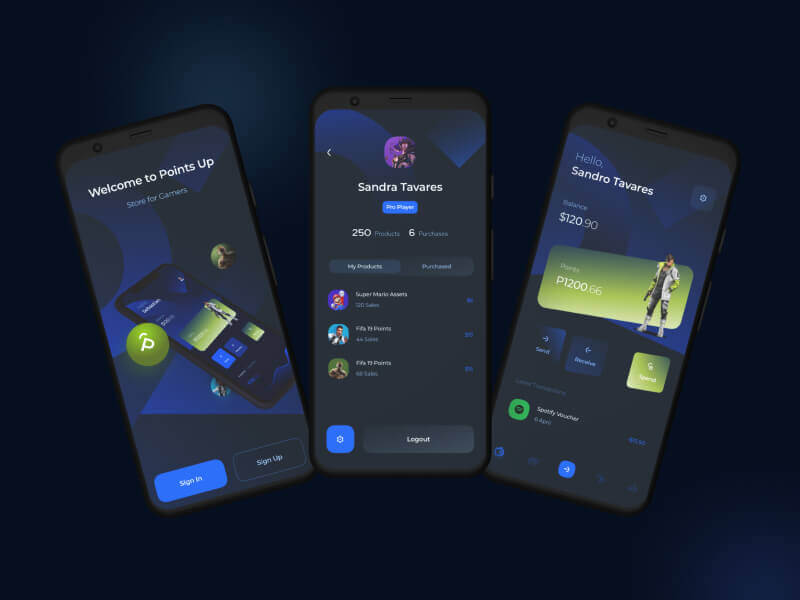

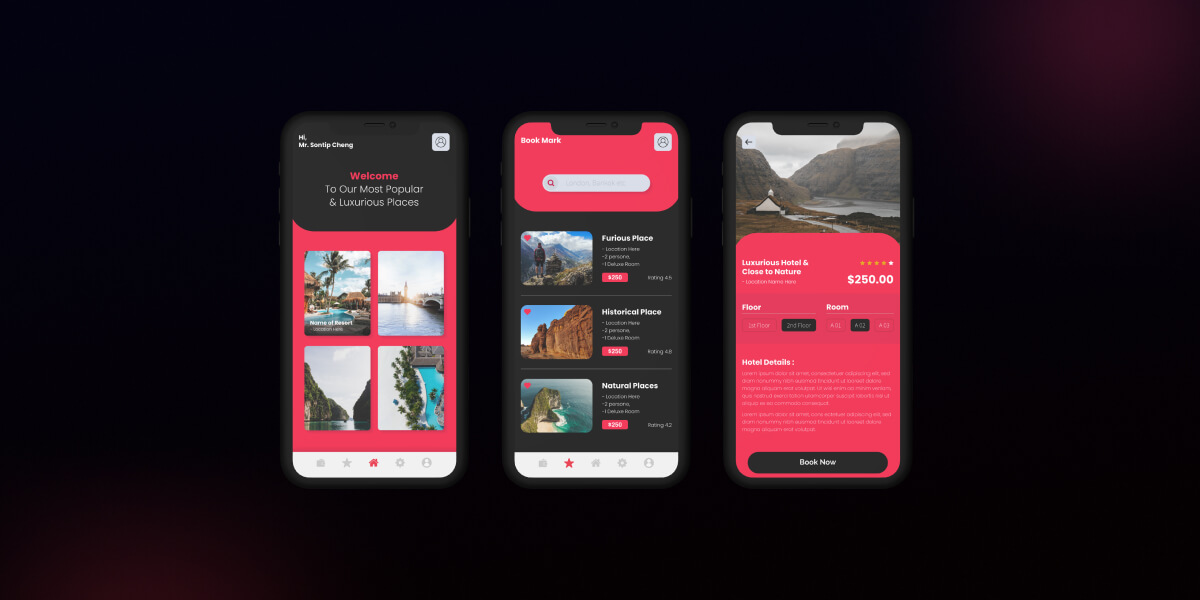

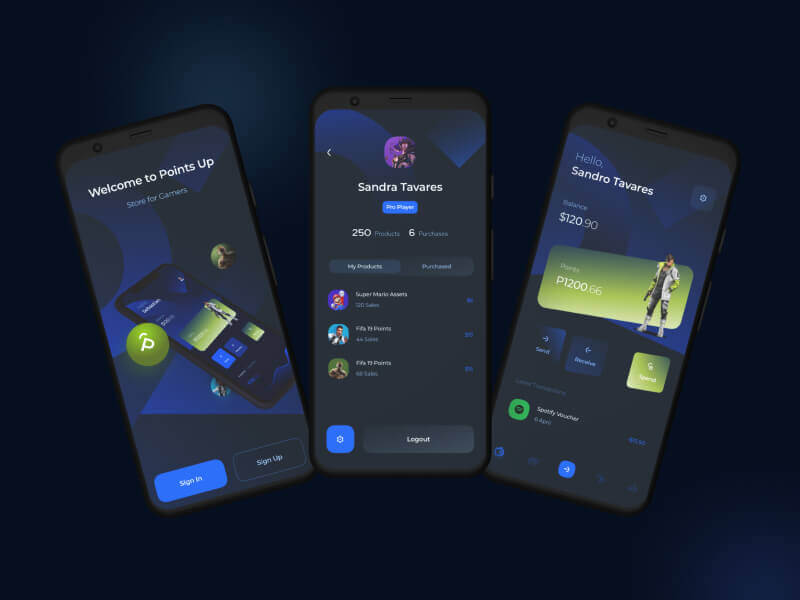

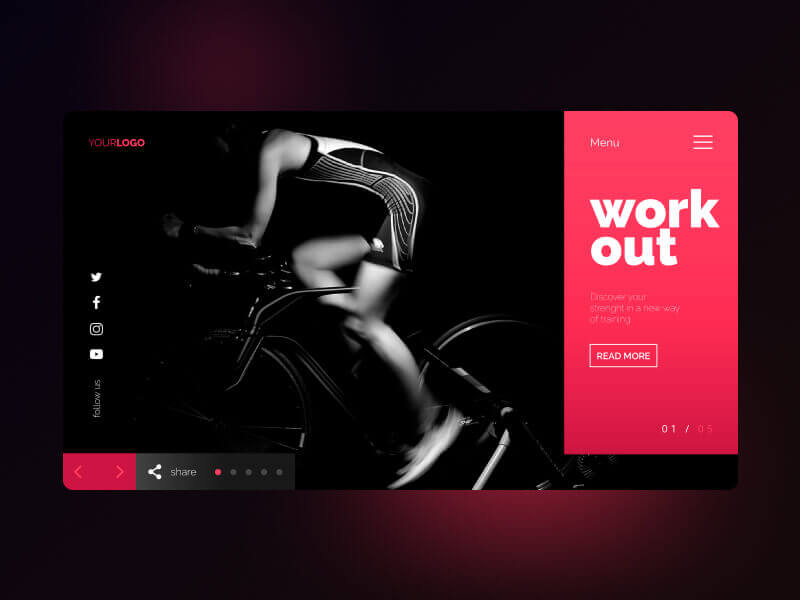

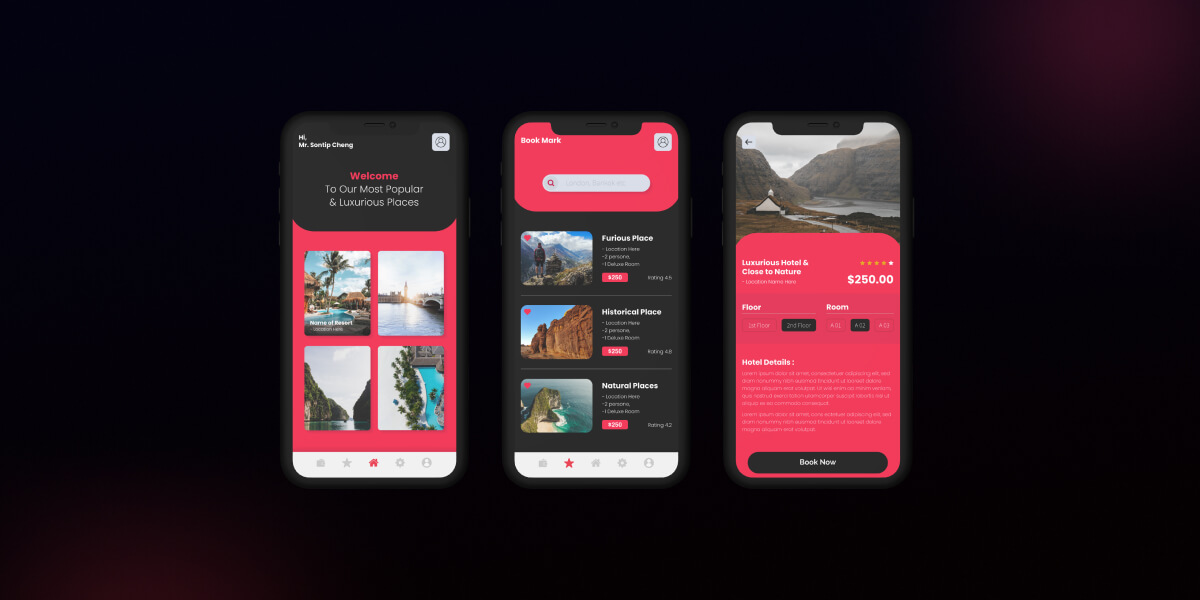

Through a wide variety of mobile applications, we’ve developed a unique visual system.

- Client George Wallace

- Date 15 June 2022

- Services Web Application

- Budget $100000+

Welcome! I'm Jared Shadduck, a dedicated professional in the field of talent acquisition. With my multifaceted skills in sourcing, screening, recruiting, and more, I excel in connecting top talent with their ideal roles. My approach is not just about filling positions; it's about understanding people, aligning interests, and fostering long-term professional relationships. I'm your partner in building a dynamic and thriving team.

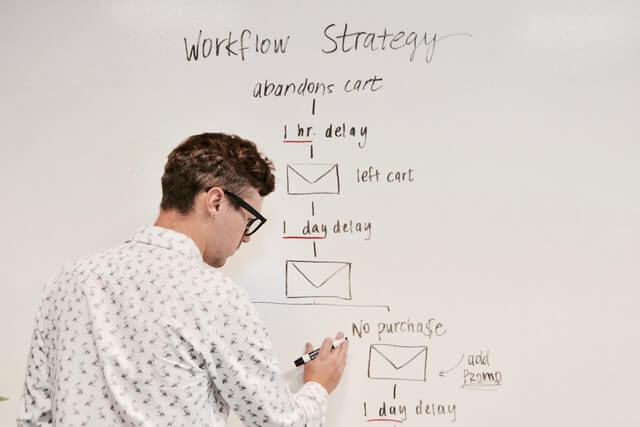

By applying and understanding the unique strategies needed for each role, we can start building an effective acquisition plan.

Knowledge is powerful. Understanding the requirements, business needs, salary distribution, typical skills and more is essential to confident offers and effective campaigns.

Creating engaging inserts and communications are key to generating effective candidate interest.

Focus on not only growing the team but also in developing a deeper understanding of the evolving market and candidate expectations.

I specialize in aligning the objectives of hiring managers, candidates, and the organization, ensuring a seamless and mutually beneficial recruitment process.

My performance as a talent acquisition professional is measured not just by the roles I fill, but by the lasting impact of those placements.

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

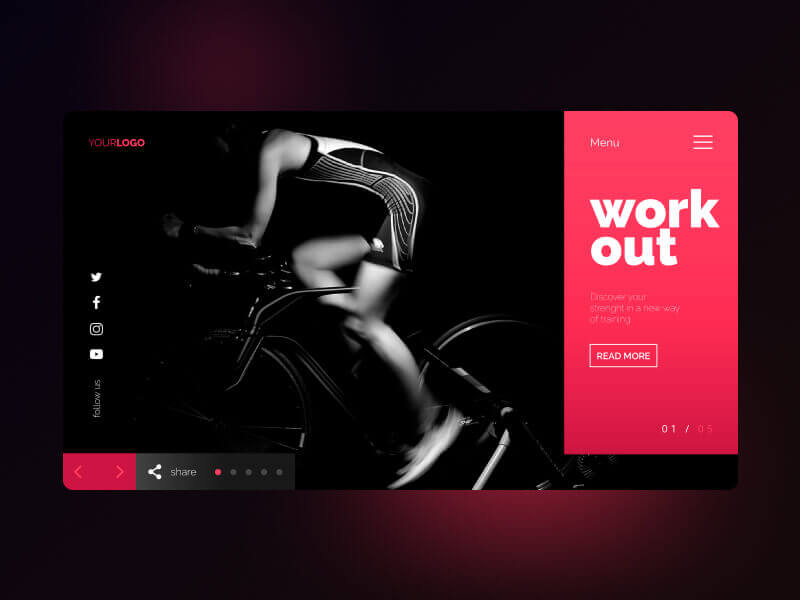

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

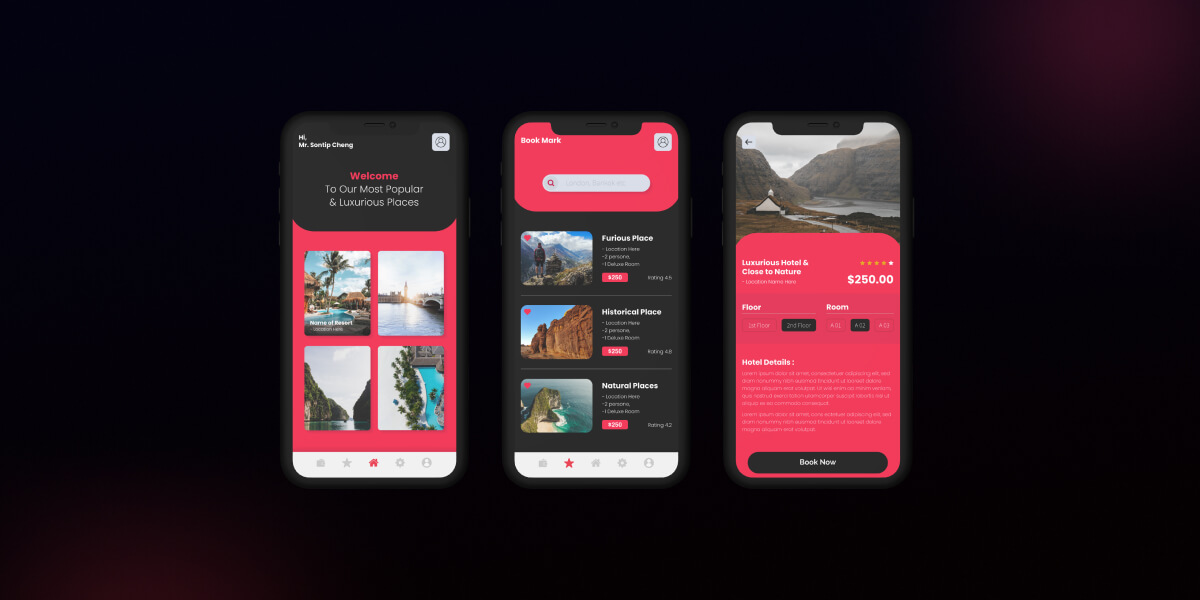

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

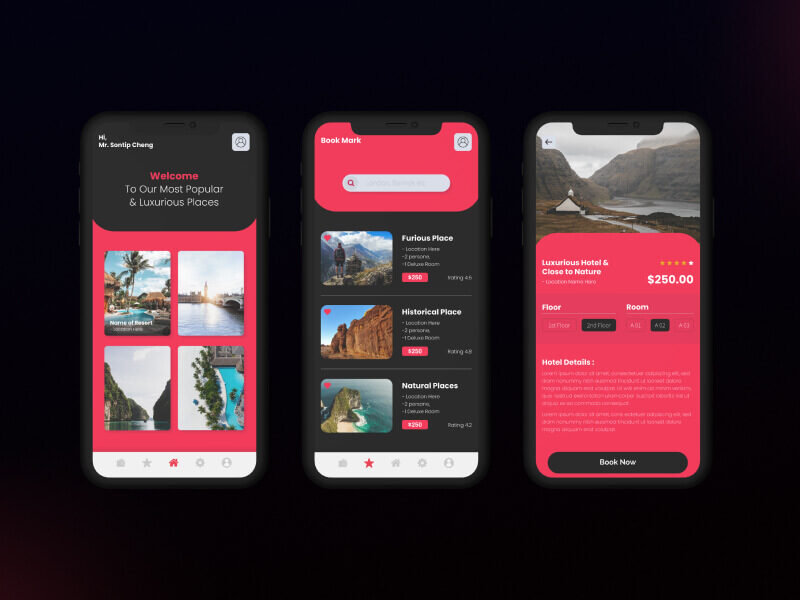

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Bachelor of Applied Arts and Science | Business – Organizational Leadership | Honors: Magna Cum Laude

Associate Degree | Business Management

Certificate in recruiting practices and strategies.

Training in copywriting for recruitment.

Training in management, and leadership.

Certificate in coaching individuals.

As a Senior Recruiter, I managed end-to-end recruitment for various roles at a startup including Product Managers, Developers, QA Engineers, Social Media Specialists, and designers. My recruiting practices and processes led to an 85% offer acceptance rate and over 100 qualified applicants per opening in 90% of roles.

As a recruiter, I oversaw recruiting goals for various tech and finance positions at Citi, including UHNW, Private Bank, Bankers, Trust, Risk, Investments, and technical roles. I managed the recruitment life cycle for Ultra High Net Worth positions, utilizing direct advertising, talent pools, and other methods to attract top talent. By collaborating with HR and prioritizing requirements, I achieved a 30% improvement in time-to-hire.

As Recruiter: - Led recruiting efforts for businesses and managed technical, software development, marketing, and operations requisitions. - Delivered 300+ requisition fills and introduced new acquisition methods, resulting in an 18% increase in stakeholder satisfaction and 25% increase in applicants.

As Senior Operations Manager, I led a team of five managers across five business support groups. I collaborated with other departments to exceed KPIs and managed all operations, including career pathing and regular follow-ups. My achievements included supporting 300+ employees while increasing VOE scores by 10% over two years. I also implemented systems such as attendance buybacks and voluntary schedule changes which led to a 15% increase in attendance within a year.

Managed 11 team leads and technical and customer support operations for 3 years. Oversaw coaching, career advancement, meetings, reporting, and action plans for efficient implementation. Received several recognition certificates, including OM of the quarter and year.

Jared's keen eye for talent and deep understanding of our company culture made the recruitment process not only efficient but also enjoyable. His ability to find the perfect fit for our team has been invaluable.

Working with Jared was a breath of fresh air. He truly understands the nuances of different roles and industries, making him an outstanding partner in our talent search.

Jared's approach to recruiting is both strategic and intuitive. He not only found us top candidates but also ensured they aligned with our long-term goals.

Author: Jared Shadduck In the rapidly changing world of talent acquisition, adaptability isn’t just a

Author: Jared Shadduck

In the rapidly changing world of talent acquisition, adaptability isn’t just a desirable trait – it’s essential for success. The ability to pivot and embrace new methodologies, technologies, and perspectives is what sets apart top talent acquisition professionals. In this blog, I delve into why adaptability is crucial and how you can cultivate it in your recruitment career.

1. The Changing Landscape of Recruitment The recruitment industry is constantly evolving, driven by technological advancements, shifting market trends, and changing candidate expectations. Staying adaptable means being open to these changes and continuously seeking ways to integrate new practices into your recruitment strategies.

2. The Power of Continuous Learning Continuous learning is the cornerstone of adaptability. Whether it’s keeping up with the latest recruitment software, understanding new hiring trends, or learning about diverse industries, ongoing education is vital. This learning mindset not only enhances your skills but also ensures you remain relevant in a competitive field.

3. Flexibility in Recruitment Strategies Adaptability in talent acquisition also involves being flexible with your recruitment strategies. It’s about customizing your approach based on the role, the industry, and the unique culture of the organization. This flexibility ensures that you are not just filling positions but are finding the right fit for both the candidate and the company.

4. Embracing a Diverse Talent Pool The world of work is becoming increasingly diverse, and an adaptable recruiter recognizes the value of this diversity. Being open to candidates from various backgrounds, with different experiences and perspectives, enriches the talent pool and contributes to building a more inclusive and innovative workforce.

5. Responding to Feedback and Challenges Adaptability also means being responsive to feedback and challenges. In talent acquisition, not every strategy will yield success. The ability to analyze feedback, learn from unsuccessful efforts, and devise new strategies is crucial for long-term success in this field.

Adaptability in talent acquisition is about being proactive, open to learning, and flexible in your approach. It’s a skill that enhances your ability to connect with diverse candidates, stay ahead of industry trends, and navigate the challenges of this dynamic field.

Are you ready to embrace adaptability in your talent acquisition career? Join me in exploring innovative strategies and continuous learning opportunities to enhance our recruitment practices.

Author: Jared Shadduck In the world of talent acquisition, effective communication is more than a

Author: Jared Shadduck

In the world of talent acquisition, effective communication is more than a skill – it’s an art. It’s the bridge that connects organizations with the right talent and shapes the entire recruitment experience. As a seasoned recruiter, I’ve learned the immense value of mastering this art. In this blog post, I’ll explore the role of communication in talent acquisition and share tips on how to enhance your communication skills.

1. Understanding Candidate Needs Effective communication starts with listening. It’s crucial to understand the aspirations, motivations, and concerns of candidates. This empathetic approach not only helps in assessing the fit but also in building a rapport that can positively influence their decision-making.

2. Clarity in Job Descriptions and Requirements The first step in attracting the right talent is clear communication in job postings. A well-crafted job description should be transparent about the role, expectations, and the culture of the organization. This clarity helps in attracting suitable candidates and sets the stage for a smooth recruitment process.

3. Regular Updates and Feedback One common grievance candidates have is the lack of communication from recruiters. Regular updates, even if it’s to say there’s no update, can greatly enhance the candidate experience. Additionally, providing constructive feedback, whether it’s for an unsuccessful application or post-interview, can leave candidates with a positive impression of your organization.

4. Building Relationships Beyond Recruitment Effective communication in talent acquisition isn’t just about filling a current vacancy; it’s about building relationships for the future. Staying in touch with candidates, even after the recruitment process, can help in creating a talent pool for future roles and also enhances your network.

5. Leveraging Social Media and Digital Platforms In today’s digital age, social media and professional networking platforms are powerful tools for communication. They provide a platform to showcase your employer brand, engage with potential candidates, and offer insights into your company culture and values.

The art of communication in talent acquisition is about creating connections, building trust, and fostering relationships. By honing these skills, recruiters can not only improve their success rate in finding the right talent but also enhance the overall reputation of their organizations in the job market.

Interested in learning more about effective communication strategies in talent acquisition? Let’s connect and share insights that can help elevate your recruitment process.

In the ever-evolving landscape of talent acquisition, staying ahead of the curve is not just

In the ever-evolving landscape of talent acquisition, staying ahead of the curve is not just an advantage – it’s a necessity. As a seasoned recruiter and talent acquisition professional, I’ve witnessed firsthand the dynamic changes in this field. In this blog post, I’ll share key strategies that are shaping the future of talent acquisition and how professionals can adapt to these changes to find success.

1. Embracing Technology and Innovation The rise of AI and machine learning has revolutionized the way we approach talent acquisition. From intelligent screening tools to predictive analytics, technology empowers us to make more informed decisions and streamline the recruitment process. However, it’s crucial to balance tech-driven efficiency with a human touch – remember, at its heart, recruitment is about people.

2. Building a Strong Employer Brand In a competitive job market, a strong employer brand is more important than ever. It’s about creating a narrative that resonates with potential candidates – one that showcases your company’s culture, values, and vision. As talent finders, our role is to be brand ambassadors, ensuring that this narrative is communicated effectively through every stage of the recruitment process.

3. Focusing on Candidate Experience A positive candidate experience can be a game-changer. It’s about respect, communication, and creating a process that is candidate-centric. This approach not only helps in attracting top talent but also in building a pipeline of candidates who might be a great fit for future roles.

4. Leveraging Data-Driven Insights Data is a powerful tool in our arsenal. By leveraging insights from past recruitment campaigns, market trends, and candidate feedback, we can refine our strategies, make better hiring decisions, and predict future hiring needs. This data-driven approach ensures that our strategies are not just effective but also relevant.

5. Cultivating Diversity and Inclusion Diversity and inclusion are more than just buzzwords; they are critical to creating a vibrant and dynamic workforce. As recruiters, we play a pivotal role in promoting diversity in hiring by advocating for inclusive job descriptions, unbiased screening processes, and diverse candidate slates.

The future of talent acquisition is exciting and filled with opportunities for innovation, growth, and impact. By embracing these strategies, we can not only keep pace with the changing landscape but also drive meaningful change in the organizations we serve.

Are you looking to elevate your talent acquisition strategies? Let’s connect and explore how we can collaborate to find the best talent for your organization.

I am currently open to hearing about new opportunities.

Phone: (512) 879-8915 Email: jared.shadduck@gmail.com